Enable Account Activity Alerts to Level Up Your Financial Super Powers

Of all the personal finance hacks I employ, I recommend one practical tip above all others: enabling activity alerts for transactions on all your financial accounts. More precisely, I’m talking about setting up spending alerts on your payment cards and bank accounts.

Most banks and credit cards allow you to set up custom alerts for activity on your account. For example, typical notification options on credit cards include:

- Balance alerts — e.g. when your available credit drops below a certain number or when your balance exceeds a certain amount.

- Payment alerts — e.g. when your payment is almost due, when your payment has been posted, or when your payment is overdue.

- Security alerts— e.g. when international, online, or gas station charges are authorized.

These are all great alerts, but for me, the most important one to enable is the notification for single transactions over a minimum amount. For example, you may want to get an alert anytime a credit card charge (or debit from your checking account) exceeds $100. Usually, you can receive such alerts via text, push notifications, and/or email.

To get the full value of spending alerts, I recommend opting for email delivery and setting the transaction threshold to $0 — so that you get an email message for every single credit card (or bank) transaction.

This practice results in a multitude of benefits, including some surprising ones. In fact, I’d go as far as to say that you gain a bunch of personal financial super powers from enabling email alerts.

Super Power 1: Incrementally Review Your Credit Card Statement

Conventional wisdom says that you should review the transactions on your credit card statement each month before paying your bill — to look for errors, fraudulent charges, posted payments, etc.

While I wholeheartedly agree with the purpose of this recommendation, you can skip this chore if you’ve enabled email alerts. The reason? If you are already reviewing real-time transaction alerts in your email inbox over the course of the month, then you already will have seen every item on your credit card statement by the time you receive it. Reviewing the transactions again would be redundant.

Super Power 2: Detect Fraud Immediately

A good credit card company often will detect suspicious charges and notify you right away (sometimes even before the charge is authorized). However, issuers don’t always detect fraudulent charges. For example, perhaps a company you do business with overcharged you. Or maybe your card was stolen and used at Target, but you usually shop there, so the activity looks routine.

If you’re getting alerts for all transactions in your email inbox, you’ll notice fraudulent charges right away — instead of days or weeks later when you receive your statement. You can contact your issuer and cancel the card if appropriate. This benefit is even more important for debit cards since (unlike credit cards) they offer little or no fraud liability protection.

Super Power 3: Discover Forgotten Subscriptions

In the age of digital content and services, you may subscribe to numerous providers for TV (Netflix, Hulu, etc.), music (Apple Music, Spotify, etc.), radio (SiriusXM), books (Kindle Unlimited), fitness classes (Peleton, Apple Fitness+), software (Dropbox, Microsoft 365, etc.), shopping (Amazon Prime, Shipt, etc.), and more.

A frequent recommendation on personal finance blogs is to periodically review subscription charges on your credit card and cancel the services you no longer use or may have forgotten about. Some companies (like Rocket Money) offer paid services to monitor and cancel your subscriptions for you.

All of this seems like overkill to me. If you have enabled spending alerts, then you will receive an email every time a subscription service charges your card. So, when you see a charge come in from Netflix, for example, you can stop and think whether you still utilize the service enough to justify the cost. And if not, you can cancel the service.

For services that bill yearly (e.g. Amazon Prime, Apple Music), you may want to set an annual calendar reminder before your subscription renewal date — so you can evaluate the service and decide whether to cancel it before they charge you.

Super Power 4: Monitor Family Member Spending

If you share a credit card with your spouse and/or kids, then you will also receive spending alerts for their purchases.

So, for example, if your daughter is spending too much on fast fashion, you’ll know pretty quickly. (My daughter now almost exclusively shops at thrift stores for environmental reasons, so fortunately I haven’t had this problem for the past few years.)

Transaction notifications offer another benefit: they can provide you with context clues about a family member’s whereabouts or status. For example, if my daughter has gone out to lunch or dinner with friends, receiving an alert for the credit card charge at the restaurant tells me that she has finished eating and may return home soon.

Or, as another example, if I’m waiting in the car (or on a bench) for my wife to make several stops at the mall (for purchases and/or returns), then I can track her progress from store to store via the credit card alerts in my email.

I find that spending alerts helpfully augment the information I can get from the Find My app on my iPhone (which also allows me to track the location of my family members).

Super Power 5: Search for Transactions with Ease

After you review each spending alert email message, I recommend you keep it instead of permanently deleting it. This practice will enable you to easily search your transaction history directly from your email account.

For example, let’s say you bought something or paid for a service but can’t remember how you paid for it. Or maybe you cannot remember when you paid for it. You may need this information for multiple reasons, including returning something for a refund or checking whether something is still under warranty.

The long way of hunting down this information would be to log into all of your credit card and checking accounts and try to find the transaction. If you have a lot of payment cards, this could take some time and end up feeling like searching for a needle in a haystack.

On the other hand, if you’ve enabled spending alerts via email, and you’ve kept all the messages, then you should be able to easily find the transaction in question simply by searching your email history.

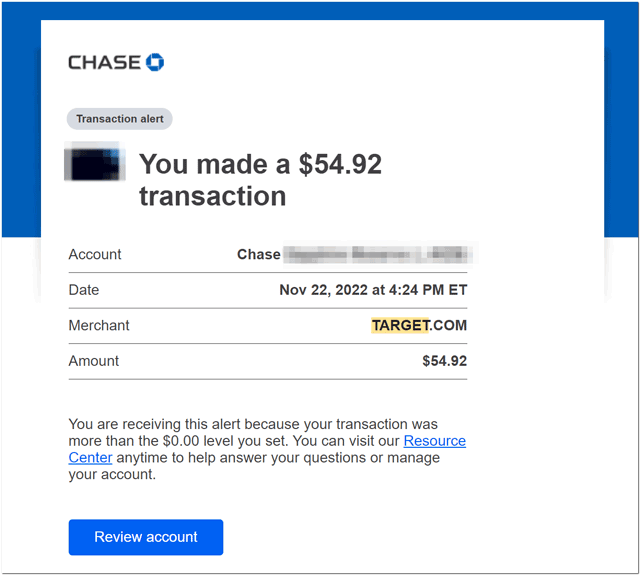

For example, to find a list of my Target transactions, I just searched for “Target.” Below is a match from one of my Chase cards. If needed to find the receipt, I’d know what date to look for.

Searchability is one of the reasons I recommend enabling alerts via email instead of (or in addition to) via text message or via push notification.

Below are some ideas for where to store your notification messages long-term, depending on how you manage your email.

- If you have an unmanaged inbox, and keep everything, then you don’t have to do anything special.

- You can archive the messages (which is what I do).

- You can delete the messages to your trash provided that you never empty your trash and your email app doesn’t automatically empty it (which many providers like Gmail and Outlook do).

- You can file the messages away in a dedicated folder (label in Gmail) — either as they arrive or after you’ve read them in your inbox.

Bonus Tips

More Thoughts On Managing Messages

If you enable payment card alert emails, you may be concerned that they will clog up your inbox. Personally, I like to receive them in my main inbox so that I see them right away. I practice inbox zero, so for every email message I receive (in general), I either flag it for follow-up, move it to a folder, or delete/archive it. In the case of payment card emails, I archive them right away.

If you are less organized than me with your email, then you may want to create a dedicated folder (or label in Gmail) for transaction alert messages. And then set up a rule/filter to automatically file all such messages to that folder. The danger of this approach is that you may ignore the folder. The email alerts are only useful if you actually look at them when they come in or shortly thereafter. So, if you do create a dedicated folder, make sure to review it at least once per day.

Other Alerts

As I mentioned at the top, banks and credit card issuers offer all sorts of alerts. So, I recommend that you review all possible alerts and enable any that would be helpful to you. For example, if you are prone to missing payment deadlines, you can enable an alert to remind you when your due date is N days away.

One alert I like to enable whenever it’s an option is notifications for credits/refunds to my credit cards. Typically, when a company refunds your purchase, they will tell you it may take several days for it to post to your account; in other words, unlike purchases, refunds usually are not real-time transactions. Instead of periodically signing into my credit card account to check on the receipt of a refund, I’d rather just get an email when it posts.

Your Turn

Do you already employ my email alert strategy? Have you derived any benefits (super powers) from it? Have some additional tips? Please let me know in the comments.

(Note: I moderate all comments so you may experience a delay before your comment appears on the post. For any SPAMMERS out there, don’t waste your time submitting as I will reject your comment.)